Bill Ellard September 10, 2017

This is the final of a three-part series where I discuss the current and upcoming battles of the “solar wars.” The three battles are netmetering, tariff reform, and grid defection. This is the grid defection discussion.

The solar wars have two main combatants – the monopoly electric utilities, and the solar (PV) industry involved with consumers who wish to own or buy solar electricity directly. Utilities are not against solar, as this new technology gives them another method to generate electricity.

What utilities dislike is their customers producing their own electricity by any means – such as solar, wind, and other on-site generators. This is called load defection. Some commercial customers are finding out that it may be cheaper to leave the grid entirely, as discussed in this 2016 article about Las Vegas casinos separating from NV Energy. (http://bit.ly/2tABsRj) This is called grid defection and will result in lower revenues for the utilities. This lowered revenue will lead to increased electric rates, incentivizing other customers to load or grid defect.

Grid Defection

Grid defection is already occurring for commercial customers, but for residential customers, we will not see this happening soon. Meeting the need for continuous and backup power generation is just not economically feasible for residential size electrical loads.

For utilities, grid defection has always been an issue in the industrial sector. Large entities such as steel mills and cement plants have traditionally used coal or natural gas for on-site generated power (http://bit.ly/2sCw0QG) for their operations. Also, these large firms have employees such as electricians to maintain a microgrid if needed.

Since these large customers can create and manage their own electricity, utilities have negotiated directly with them on really low electric rates to keep them as customers. In some states, residential customers can pay 80% more per kilowatt-hour for their electricity. (http://bit.ly/2tAmPh7) We will now explore the three main trends that will encourage further grid defection: solar Power Purchase Agreements (PPAs), utility demand charges, and battery pricing.

Solar Power Purchase Agreements (PPAs)

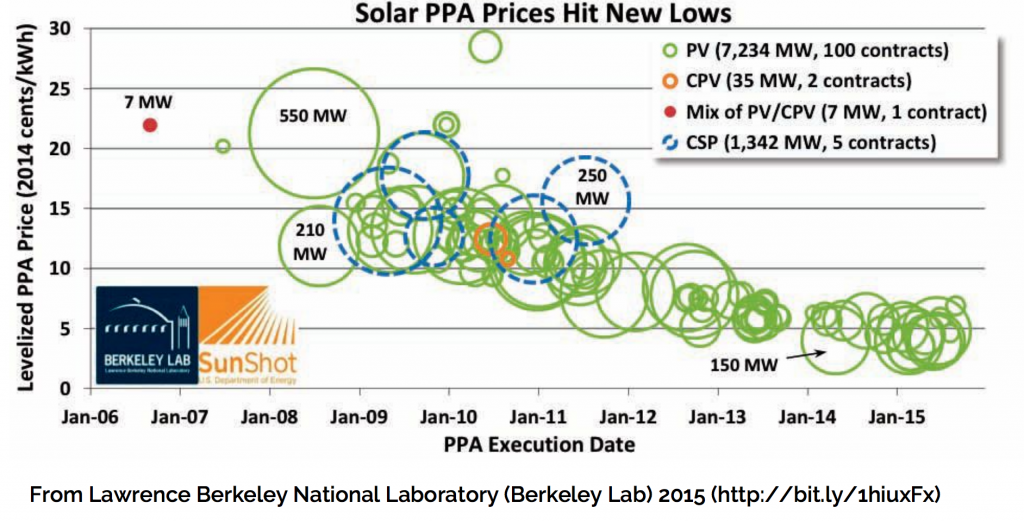

As seen in the below graphic from 2015, the average solar PPA price fell 70% in just 5 years to below 5 cents per kilowatt-hour. More recently, solar prices have fallen even more dramatically to a new record low of 2.42 per kilowatt-hour (http://for.tn/2rsktA0). Also, important to note, this record low pricing is unsubsidized. These low solar power contracts caught the attention of some of the casinos in Las Vegas, such as the MGM mentioned in the Las Vegas casinos article referenced above. The pricing for these solar power contracts were low enough for MGM to leave their utility and pay a $87 million exit fee! (http://bit.ly/1TLMo8d)

Considering 2017 we will see even lower pricing due to another 20%+ drop in the average selling price for solar modules, as indicated by the Lawrence Berkeley Lab.

Demand Charges

Typically, demand charges are applied to commercial and industrial customers only. This charge is based on the highest 15-minute interval of electricity use during the month’s billing period. These charges can be up to 70% of a customer bill. (http:// bit.ly/2rIAGQM) The demand charge is like another facility fee, and solar alone will not reduce this charge. This is one reason why commercial and industrial firms have not installed solar.

The other option a business has is grid defection. So now the economics may work well with PV, combined heat and power generation, and some amount of storage. This could involve either full grid defection or load defection.

Battery Pricing

Trends Like the dramatic decline in solar module prices, we are seeing the same large decline in energy storage costs. In 2016 energy storage startup Stem’s CTO described a 70% reduction in lithium ion battery prices in just 18 months. (http://bit.ly/2mZvQRq) Tesla’s battery costs are now below $200 per kilowatt hour. (http://bit.ly/2aFAKZM)

Tesla has not even fully ramped up its manufacturing yet. These much lower storage prices for small to medium-sized businesses will lead to more demand charge shaving and grid defection options.

2017 Trends

The combination of extremely low solar power pricing, falling battery pricing, and high demand charges will encourage more commercial entities to do what MGM did in Las Vegas – leave the grid, or load defect.

With these grid/load defection dynamics in mind, I see this as a positive for Tesla. Tesla is an obvious choice since its acquisition of SolarCity and its positioning into solar and energy. Innovation will be the key, with not just cheaper options, but more elegant and innovative options.

We may also see residential installations with smarter inverters that enable customers to eliminate the need for net-metering agreements from their utilities. Innovation in this area would include smart software for charge controlling and energy curtailment. Innovation in this space would come from firms like Tesla and SolarEdge Technologies.

Summary

- The grid defection battle has begun as companies in some parts of the USA are finding the cost of solar to be cheaper than their respective utility rates.

- This battle is just beginning, and will be the final battle in the solar wars.

- The implications of this final battle are dramatic and will affect the utility and solar sectors in the USA. Tesla will be a winner in these.

Bill Ellard is an energy economist and consultant, serving businesses, utilities, and municipalities and focusing on distributed generation implementation, solar energy, demand response, demand side management, microgrid development, facility energy management, and renewable energy integration. He can be reached at bellard@yahoo.com

Bill Ellard is an energy economist and consultant, serving businesses, utilities, and municipalities and focusing on distributed generation implementation, solar energy, demand response, demand side management, microgrid development, facility energy management, and renewable energy integration. He can be reached at bellard@yahoo.com