By Mike Sloan, CEO Synergetic March 23, 2022

The $1.2 trillion Bipartisan Infrastructure Law signed on November 15, 2021, funds a never-before opportunity to accelerate clean energy deployment that commands focus of this issue of Solar Today. © ongpatong

In 13 years, America’s electricity supply will be entirely free of carbon-belching smokestacks fueled by coal, oil and natural gas.

In 28 years, the entirety of the American economy – trains, jets, factories, steel mills, chemical plants – will emit not one net molecule of fossilized carbon into the sky.

Many among us, from the uninformed to highly learned energy experts may use a single word in response: Impossible.

Undeterred, and to their great credit, the Biden Administration is launching forward in unprecedented fashion, prioritizing focus on the most critical actions needed to address climate change: electric transmission planning reform, funding for new infrastructure, storage technology, hydrogen, electric vehicles, social justice.

Will it be enough? The answer will ultimately be judged not by current effort, but by future results.

Overview

Humans are remarkably resilient and adaptive creatures. During the past 200,000 years that our ancestors have walked the planet, changing climate has driven sea levels up and down from higher (30 feet) to dramatically lower (425 feet) than observed today. Through plagues, extinction of preferred food supplies, super volcanoes and scorching fireballs assaulting from the sky, we as a species have survived.

But the present climate crisis threatens not just isolated bands of nomadic tribes. Billions of people and their complex interrelated economic and social systems must adapt.

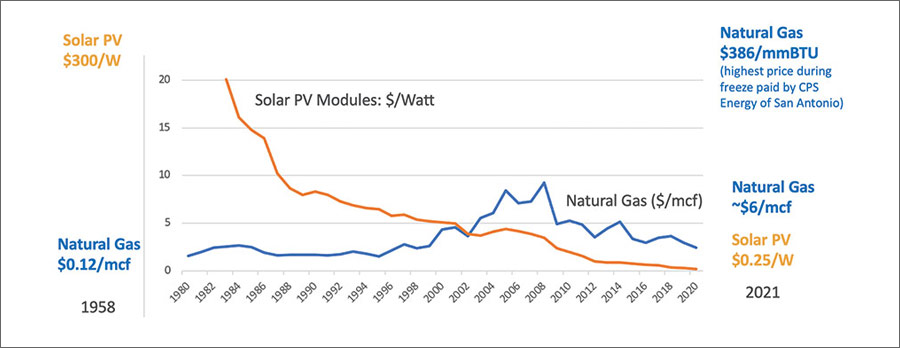

Fig 1: Relative Energy Cost Trends: Natural Gas versus Solar (1958-2021). Due to the extreme price differential, data before 1980 is not plotted. © Synergetic from EIA, IEA and CPS Energy data

This article features perspectives from the author rooted in decades of working on renewable energy infrastructure issues in Texas. It highlights formidable challenges and offers specific suggestions as the nation crafts its energy strategy.

In addition, this “infrastructure” issue is bolstered with substance from many experts who are deep in the details, working diligently in various areas to accelerate the energy transition. Solar Today is grateful to the following for their contributions to this issue:

- Julia Matevosyan: Integrating 100% Clean Energy

- Rob Gramlich: Transmission Policy Recommendations

- Alison Silverstein: Decarbonization, Resilience and Equity

- Janice Lin: Green Hydrogen Coalition

- Blaine Collison: Renewable Thermal Collaborative

- Pattern Energy: New Mexico’s Western Spirit Project

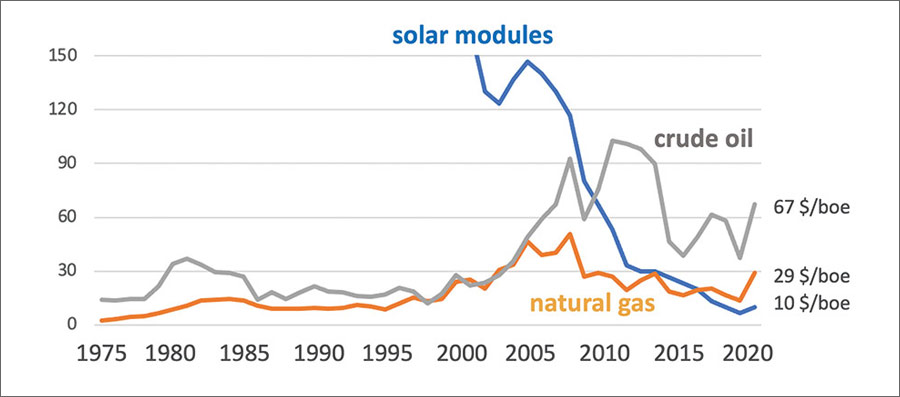

Fig 2: Relative Energy Costs in Dollars per Barrel of Oil Equivalent. Three indexed commodities – crude oil, natural gas and solar modules – are depicted on a common cost basis. Annual average solar module prices (from IEA) have been divided by module lifetime energy production assuming only warrantied electric production (25 years) at average utility-scale performance (25% capacity factor). © Synergetic from EIA and IEA data

The Opportunity

While Americans love to share their opinions, intellectual discourse in the country has largely segregated into clusters of common thought. Broader conversations are needed, optimally with a common set of facts as a starting point. Let’s begin with a fundamental question:

What do different energy sources cost and how has that changed over time?

In the late 1950s, as the space race was starting to gain momentum, photovoltaic (sunlight-to-electricity) technology moved from the lab to a real application: power for hard-to-refuel space satellites. These first solar cells cost $300 per watt. Meanwhile, U.S. natural gas in 1958 was heavily regulated and averaged $0.12 per Mcf. Marching forward to 2020, solar module prices had dropped from outer space down to $0.20 per watt while market-priced natural gas approached $3 per Mcf. During winter storm Uri in 2021, gas spiked to more than $300 per Mcf.

This long-term trend is staggering – a more than 20-fold cost increase for natural gas compared with a 99.9% cost reduction for solar modules – but the meaning sharpens when put on a common basis of dollars per barrel.

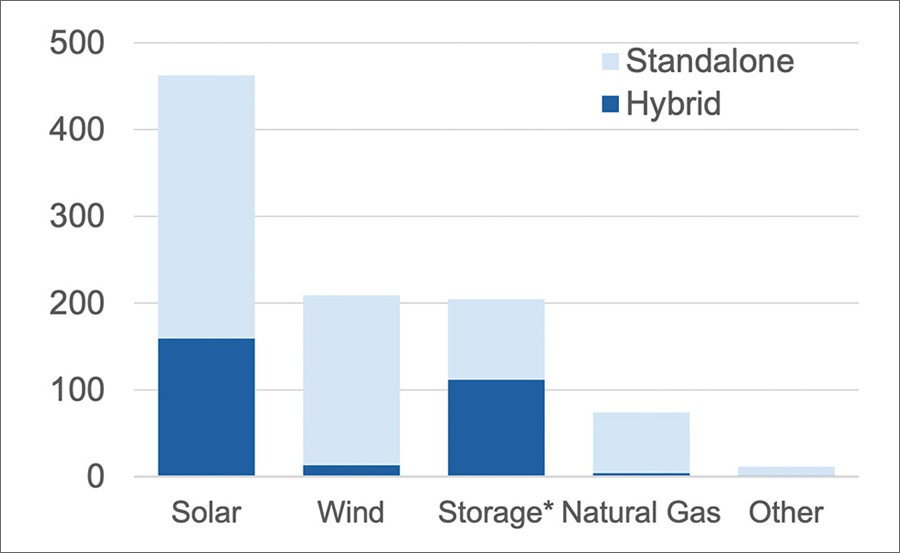

Fig 3: Electric Capacity (GW) in Interconnection Queues at the End of 2020 (LBL). Across the USA, more than 90% of electric power plant interconnection requests are solar, wind and storage. Less than 10% is natural gas (largely in the Southeast where gas units are replacing retiring coal). © Lawrence Berkeley National Laboratory

While debate of graph details is encouraged, the trends and direct cost comparison seem decisive: solar is now cheaper than oil and gas. That’s the reason nearly half of all proposed electric generating capacity additions in the U.S. are now solar (Fig.3). It also means the cost of driving an electric car can be dramatically lower than driving the petroleum-fueled ones now in most American driveways (Fig. 4).

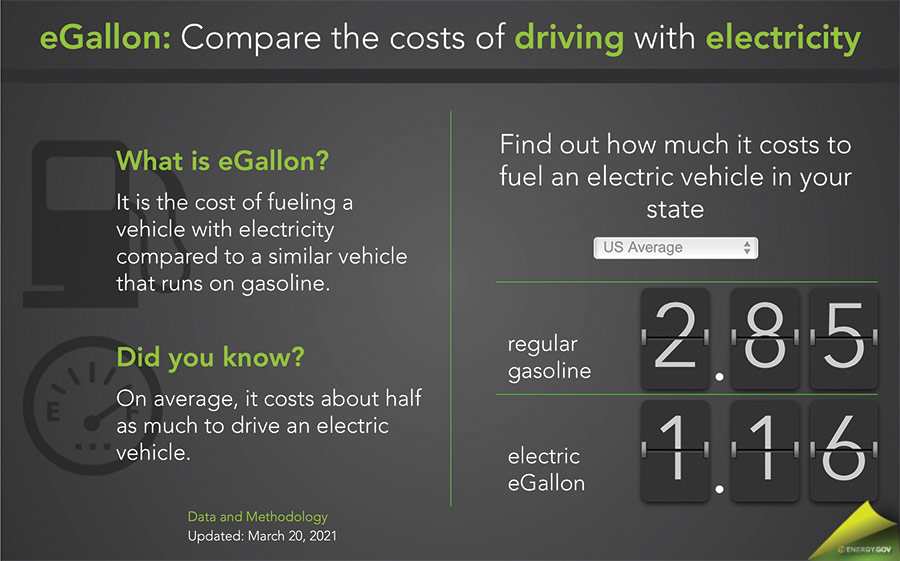

FIG 4. DOE’s Cost Comparison for Fueling Electric Vehicles versus Gasoline. Powering an electric car costs much less than fueling with gasoline – less than half per DOE’s eGallon web page (which assumes EVs are charged at a national average residential electric rate of 14 cents/kWh). © US DOE

With crude oil recently surpassing $110 per barrel, average retail gasoline prices have risen 30% from the $2.85 in DOE’s chart ($3.73 as of March 2, 2022) suggesting even greater potential savings. If America’s entire fleet of cars switched to 100% electric power instead of burning 140 billion gallons of gasoline, consumers’ annual fuel bill would drop by $200 billion to $300 billion.

The differential is even more extreme when comparing wholesale gasoline ($3.13 per gallon) to wholesale wind and solar (less than $0.26 per eGallon in good areas; sub 3 cents per kWh). Shockingly, when it comes to the cost to fuel an automobile, wholesale gasoline and diesel are now 10 times the cost of wholesale wind and solar. That extreme spread could finance a tremendous amount of new electric transmission infrastructure to low-cost clean energy production zones, support road construction and still deliver overall consumer savings for transportation.

Customers and investors alike now clamor for climate tech. The solar future environmentalists have so long dreamed about is at hand – clean, cheap, abundant, sustainable.

What could possibly hold things back?

The Problem

Logistics. Renewable energy generation is undeniably ready for prime time, the infrastructure needed to get it to interested consumers is not.

Electricity in the U.S. is an intrinsically “fragmented” industry, a patchwork of companies and wires that spread and morphed over time to generate power on demand, slowly expanding from where there were many to where there were few. The result is a tremendous diversity of entities involved in electricity – more than 3,000 sell retail electricity. Different governance. Different rules. Different objectives. Different decision-makers.

The U.S. electric grid is likewise a complex onion of organization, ownership and regulation – much more so than anywhere else in the world. Even after market reforms, many nations retain a dominant transmission service provider (TSP). China’s “State Grid” serves 1.1 billion people (more than 3X the US population) with transmission lines spanning as far as 2,100 miles (the distance from CA to FL). Russia’s “Federal Grid” serves 15 million square kilometers (almost 2X the area of the contiguous US). In Europe, almost every nation has a single TSP. In the U.S., there are hundreds of transmission service providers. Texas alone has 68.12.

Ever since 1896 when Westinghouse strung wires connecting hydro-generators at Niagara Falls to Buffalo 20 miles away, U.S. electricity infrastructure expansions have generally connected power plants with nearby customers. Especially with the relative ease of moving and storing America’s abundant fossil fuel supplies, there has not historically been a pressing need to move large volumes of electricity great distances.

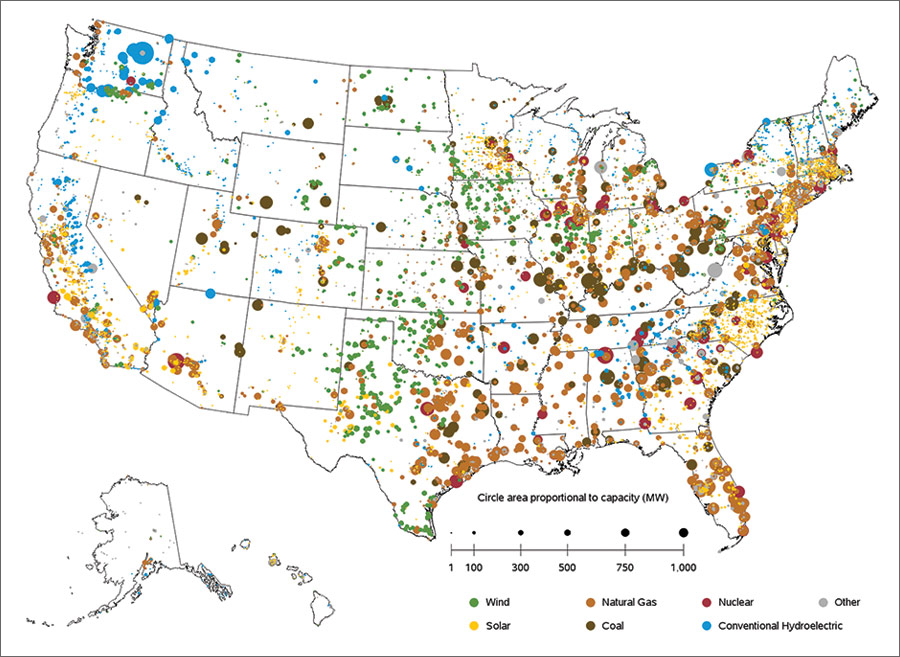

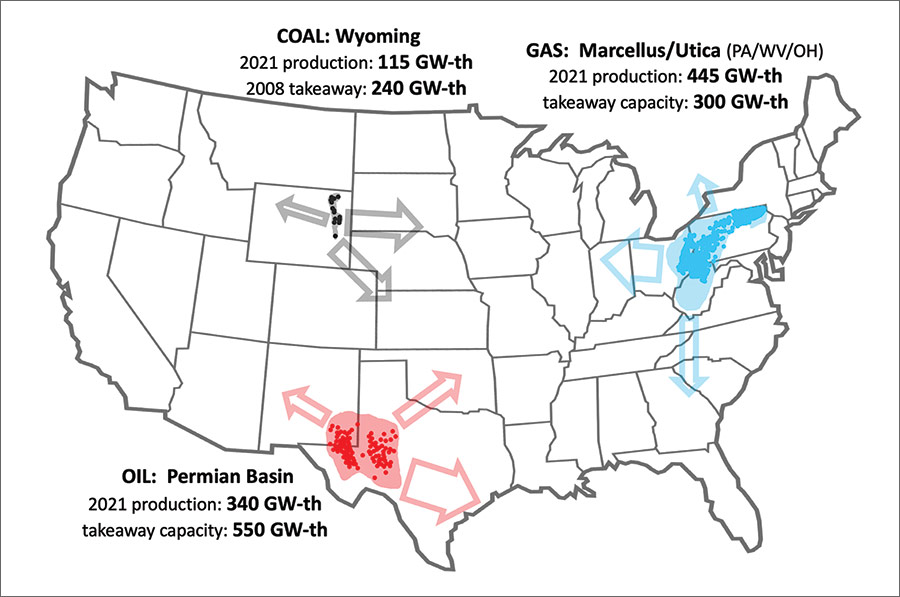

In contrast to electric generation (Fig. 5), fossil fuel production is concentrated in the best resource areas and transported as far away as needed. America’s coal, oil, and gas production areas have massive takeaway capabilities that can serve global markets (Fig. 6). Eleven states produce 90% of U.S. coal with Wyoming alone supplying more than 40%. Chunks of solid carbon roll from Wyoming by coal train across America from sea to shining sea, at its peak in 2008 delivering 24/7 the equivalent of 240 GW-th (gigawatts of thermal energy). For perspective, the electric consumption of the entire U.S. is equivalent to 450 GW of continuous electric demand.

Fig 5: Map of Operable Utility-Scale Generating Plants as of November 2021 (EIA). All states produce electricity. Only 4 states – all in New England – import more than a third of their overall electric needs. Palo Verde nuclear plant (3.9 GW) in Arizona generates the most electricity among U.S. power plants (32 TWh/yr) with a fuel requirement averaging ~10 GW-th. © U.S. Energy Information Administration, Form EIA-860

Fig 6: Largest Coal, Oil and Gas Production Zones have Massive Takeaway Capacity. While a significant portion of Marcellus gas is used locally in Northeastern states, mined fossil fuels regularly travel to users across the country and globe. In 2021, coal produced in Wyoming was worth $3 billion, natural gas in the Marcellus/Utica worth $50 billion, and oil from the Permian Basin worth $150 billion. Fossil fuel production is extremely important in these local economies. © Synergetic from eia.gov & spglobal.com

Just six states produce 90% of U.S. oil. Once the U.S. ban on oil exports was lifted at the end of 2015, a massive pipeline building spree ensued between West Texas and Gulf coast ports. Permian Basin takeaway capacity leapfrogged beyond 8 million barrels per day of oil (550 GW-th) and 19 Bcf per day of natural gas (235 GW-th). Oil and natural gas from New Mexico and West Texas can travel a 15,000+ mile path over land and sea finding its way to customers in China and Korea. Excess takeaway capacity is ready to support substantial growth in new drilling and production.

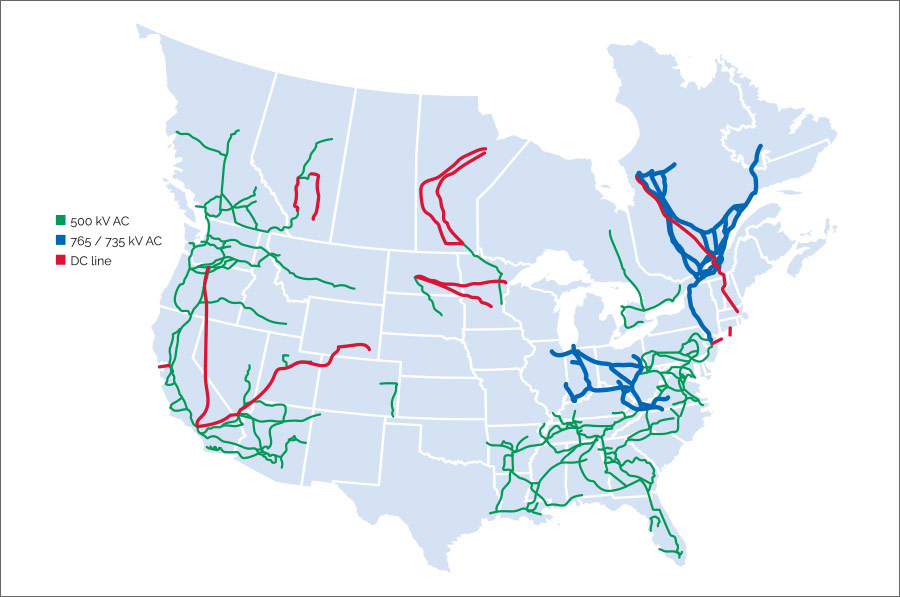

The picture for moving electricity is starkly different (Fig. 7).

Fig 7: High Voltage and Direct Current Transmission Lines are Sparse in the U.S. Power lines of 345 kV and lower support local electrical needs in the middle of the U.S. Meanwhile, Quebec, with a population of 8 million and a single TSP, has the strongest transmission system in all of North America, using 735 kV transmission lines as long as 750 miles to harness exceptional hydropower resources (~34 GW in service) and deliver to cities like Montreal and support substantial export (~8 GW) into the U.S. © Synergetic from FERC & ESIG

The U.S. transmission grid is void of large transmission lines capable of multi-GW transfers of power across the center of the U.S. This gap – where the best wind resources are located – further serves as a transmission desert blocking the best solar in the Southwest from reaching the population-rich Eastern U.S.

The current U.S. grid is grossly inadequate to facilitate the scale of decarbonization now contemplated. Electricity transfer is not even a fully “regional” industry much less national or global. But the problem is not just inter-regional. Across the country, viable projects and interested clean energy buyers are frequently stuck, unable to resolve the transmission risks, even if only a few hundred miles apart.

In Texas, the most successful wind and solar market in the U.S. with 45 GW, more clean energy projects get canceled than built. The electric transfer capability from all of West Texas is constrained to 11 GW-electric, severely limiting additional wind and solar development in one of America’s best renewable energy production zones.

This is an unfortunate reality facing U.S. queues elsewhere stuffed with renewables waiting on new transmission.

While batteries will help, there simply is not enough infrastructure.

Biden’s Whole-of-Government Approach

No President has ever placed more focus on climate crisis action than Joe Biden. From forming the first-ever National Climate Task Force – mobilizing every agency to prioritize acting on climate change throughout the entire federal government – to convening world leaders to leverage U.S. international leadership guided by Special Presidential Envoy for Climate John Kerry, the Biden-Harris Administration is tackling the climate crisis at home and abroad. The $1.2 trillion Bipartisan Infrastructure Law signed on November 15, 2021, funds a never-before opportunity to accelerate clean energy deployment that commands focus of this issue of Solar Today.

In the whole-of-government effort to tackle the climate crisis, none is asked to shoulder more load than Sec. Jennifer Granholm’s Department of Energy (DOE). Among the many initiatives DOE is leading:

Energy Earthshots Initiatives to accelerate needed energy transition breakthroughs.

Building a Better Grid Initiative supporting the buildout of long-distance transmission through collaborative National Transmission Planning, innovative financing mechanisms, coordinated permitting, and research and development.

Loan Programs Offic, reenergized under solar entrepreneur Jigar Shah, with $40 Billion to help deploy large-scale energy infrastructure in the U.S.

Also on the front line of infrastructure action is the Federal Energy Regulatory Commission (FERC), which regulates interstate commerce of electricity and natural gas and has various powers involving interstate power lines and pipelines. FERC has already taken action on a Transmission Line Ratings Rule to squeeze more utilization from the existing grid and has strengthened backstop siting authority for the construction of new electric lines in areas designated National Interest Electric Transmission Corridors. There have been years of thoughtful effort on how to build a better grid, with clear recognition of the importance of scenario planning that stretches well beyond business as usual. Comments of DOE’s Michelle Manary regarding FERC’s rulemaking on Building for the Future Through Electric Regional Transmission Planning and Cost Allocation and Generator Interconnection illuminate such thinking. Additional expert content included in this issue provides varied perspectives for how to seize upon this special opportunity to accelerate the energy transition.

Renewable Thermal Collaborative

Energy used for heating and cooling comprises approximately 50% of total global final energy demand. Additionally, global heat production is responsible for 39% of energy-related carbon dioxide emissions. In the United States, heating and cooling account for more than 25% of total energy use across residential, commercial, and industrial sectors at a cost of $270 billion annually.

The Renewable Thermal Collaborative (RTC) is the global coalition for companies, institutions, and governments committed to scaling up renewable heating and cooling at their facilities to dramatically reduce carbon emissions. RTC members recognize the growing demand and necessity for renewable heating and cooling and the urgent need to meet this demand in a manner that delivers sustainable, cost-competitive options at scale.

The RTC’s strategy is to replicate the success that has occurred in renewable electricity markets, where corporate and other institutional buyers have used their market demand and influence to drive down prices, simplify access, and scale deployment of renewable technologies.

The RTC’s current and pending workstreams include: market development, greenhouse gas accounting and renewable thermal attributes, U.S. federal and state policy, electrification, renewable natural gas, green hydrogen, solar thermal and thermal storage.

RTC members include multinational manufacturers, health care and university systems, and state and local governments. RTC sponsors are renewable thermal suppliers, technology developers, utilities, energy advisors, financiers,

non-profits, and service providers that support deployment of renewable thermal solutions

for large customers.

About the Renewable Thermal Collaborative (RTC)

RTC was founded in 2017 and is facilitated by the Center for Climate and Energy Solutions, David Gardiner and Associates, and World

Wildlife Fund.

This article concludes with three suggestions based on the author’s deep experiences in Texas, which include the determined naivety to ask for things that never before worked. The Texas RPS and Competitive Renewable Energy Zone (CREZ) are examples that success is sometimes built on a foundation of failures.

Suggestion #1:Include Robust Storage Scenarios in National Transmission Planning.

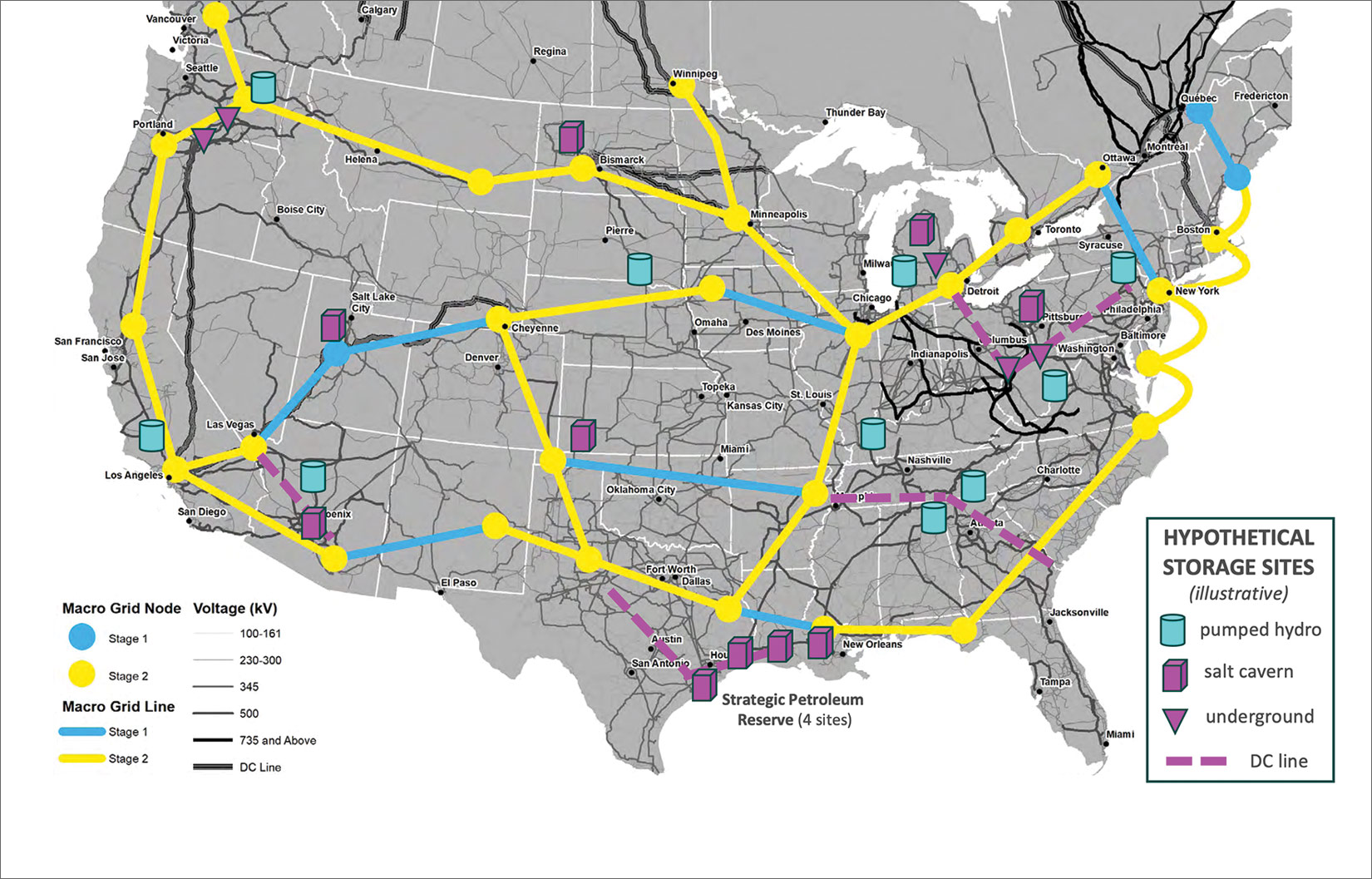

Selection of Hydrogen and Long-Duration Storage as the first two Energy Earthshots demonstrates DOE’s prioritization of these issues. But recognition of which specific technologies and approaches move to the front of the long-duration storage race will take years. Some technologies (e.g., batteries) benefit from tremendous locational flexibility while others like pumped hydro, gravity machines and geologic storage are location specific. Electric grid planning scenarios developed in 2022 should contemplate a very broad range of possible storage options as well as the repurposing of existing assets serving traditional energy sources (Fig. 8).

Fig. 8: National HVDC Grid Concept incorporating Hypothetical Storage Zones. Additional potential storage types should be considered beyond those illustrated here over ESIG’s conceptual “macrogrid” overlay. Real plans and target sites must factor in technical, economic and political issues. © Energy Systems Integration Group, Feb. 2021 + storage icons by Synergetic

A critical aspect of storage is “deliverability.” Interestingly, Texas had plenty of natural gas in storage facilities to ride through winter storm Uri in 2021 if it could have been pulled out of storage fast enough. It couldn’t. Rapid response during emergencies across multiple states must focus on both storage and deliverability to

achieve resilience.

New power lines take a long time to build. Highly versatile battery storage and solar will be immediate solutions across the U.S., but deep decarbonization will require much more infrastructure – new and repurposed. The quickest way to export massive amounts of Wyoming wind is to load it on railroad cars. Hydrogen is a possible pathway to do that.

Suggestion #2: Modernize the Strategic Petroleum Reserve to Serve the Digital Age

“The mission of the Strategic Petroleum Reserve (SPR) is to protect the United States (U.S.) from severe petroleum supply interruptions…” [DOE] The SPR has served its purpose well, and with the U.S. now the world’s largest oil producer and a net exporter of oil in 2020, the time is ripe to ask: Should America continue to stockpile carbon if striving for a decarbonized future?

America’s 21st century energy security strategy should better serve the electric-intensive digital economy. A new Strategic Hydrogen Reserve would be a powerful federal tool for climate protection that would:

- Spur advancement of the hydrogen economy;

- Energize storage opportunities for wind and solar

- Diversify electric emergency response capability.

A seemingly logical approach would be to transition, over a practical number of years, the nation’s strategic energy stockpile away from an unprocessed carbon fuel (crude oil, currently worth $60 billion) to a carbon-free fuel ready for immediate use (such as hydrogen or ammonia). The four sites in Texas and Louisiana that host the Strategic Petroleum Reserve happen to be located in close proximity to the largest hydrogen pipeline system in the world, numerous hydrogen users, many power plants and advanced energy export facilities that ship liquids and gases around the globe.

A possible first step is a pilot program at the Bryan Mound SPR (Fig. 9) near Houston to explore if assets can be converted to support electricity and decarbonization via options such as compressed air, ammonia or hydrogen. If this giant storage system were connected to area power plants to serve as an alternative fuel during emergencies, the energy contained in a single cavern at Bryan Mound as a liquid hydrogen carrier (such as ammonia) is greater than the 5-day total of electric load forced offline across Texas during winter storm Uri.

Fig. 9: Strategic Petroleum Reserve Facility at Bryan Mound. The 20 underground caverns at this SPR site hold up to 254 million barrels of oil – the world’s largest chemical storage facility. © U.S. Department of Energy Office of Fossil Energy and Carbon Management

Suggestion #3: 21st Century Transcontinental Infrastructure Corridors

Building the infrastructure needed to fully decarbonize America is daunting, but the primary obstacles are not technical or economic – they are man-made. With appropriate urgency and commitment, unprecedented actions can happen quickly.

The coal-powered 19th century saw routes for transcontinental railroad and telegraph lines become a national priority. The U.S. government acquired property by force and purchase, provided land grants to industrialists and the first of several transcontinental railroads – the 1,928 mile long “Pacific Railroad” – was built largely by hand labor in just six years.

The 20th century was the age of oil and the automobile. Oil and gas pipelines were deemed important for “public use” and given powers of “eminent domain” (powers that remain today). When German submarines began sinking U.S. oil barges during WWII, finding an alternate path became a wartime imperative. The U.S. government took charge in securing a route and partnered with the oil industry to build a 1,254-mile-long Texas-to-New Jersey pipeline that was constructed in 350 days. Some historians credit this accelerated infrastructure investment as crucial in the defeat of Hitler.

The following planning scenario assumes a “speed it up as if our lives depend on it” action plan. It presumes strong federal action under a “national security” imperative undeterred by traditional limitations to achieve multi-solution infrastructure needed for the 21st century. Events in Ukraine underscore the need for urgent framing.

Priorities of this planning scenario draw on goals identified by DOE for use with National Transmission Planning but are expanded beyond electricity:

- Federal action should complement and enhance activities that regional frameworks handle (commit to fully transcontinental corridors transecting transmission planning regions and established infrastructure pathways such as interstate highways

and pipelines); - Provide multiple solutions: decarbonization, diversified energy, water, data, economic development, social justice (include symbiotic products in a common

infrastructure corridor); - Seek maximum cooperation with stakeholders but with the backstop of certainty of federal action to achieve outcomes (seek pathway through a “coalition of willing” but

use condemnation as needed to expedite completion); - Include export capability for hydrogen/carbon-neutral chemical energy.

DOE to Create New Undersecretary for Infrastructure

On February 15, the Department of Energy (DOE) announced a new undersecretary position to focus much of the agency’s infrastructure law responsibilities. Tasks will include oversight of the Loan Programs Office; the Office of Indian Energy Policy and Programs; the Office of Clean Energy Demonstrations; the Office of Cybersecurity, Energy Security and Emergency Response (CESER); and the Federal Energy Management Program. In addition, three new offices will be under the new undersecretary’s purview:

On February 15, the Department of Energy (DOE) announced a new undersecretary position to focus much of the agency’s infrastructure law responsibilities. Tasks will include oversight of the Loan Programs Office; the Office of Indian Energy Policy and Programs; the Office of Clean Energy Demonstrations; the Office of Cybersecurity, Energy Security and Emergency Response (CESER); and the Federal Energy Management Program. In addition, three new offices will be under the new undersecretary’s purview:

- The Grid Infrastructure Office – responsible for deploying DOE’s new grid transmission authorities in addition to implementing incentives for hydropower and existing at-risk nuclear reactors.

- The Office of Manufacturing and Energy Supply Chains will implement provisions related to critical minerals, advanced manufacturing and battery recycling.

- The State and Community Energy Program will help with outreach for doling out the infrastructure dollars.

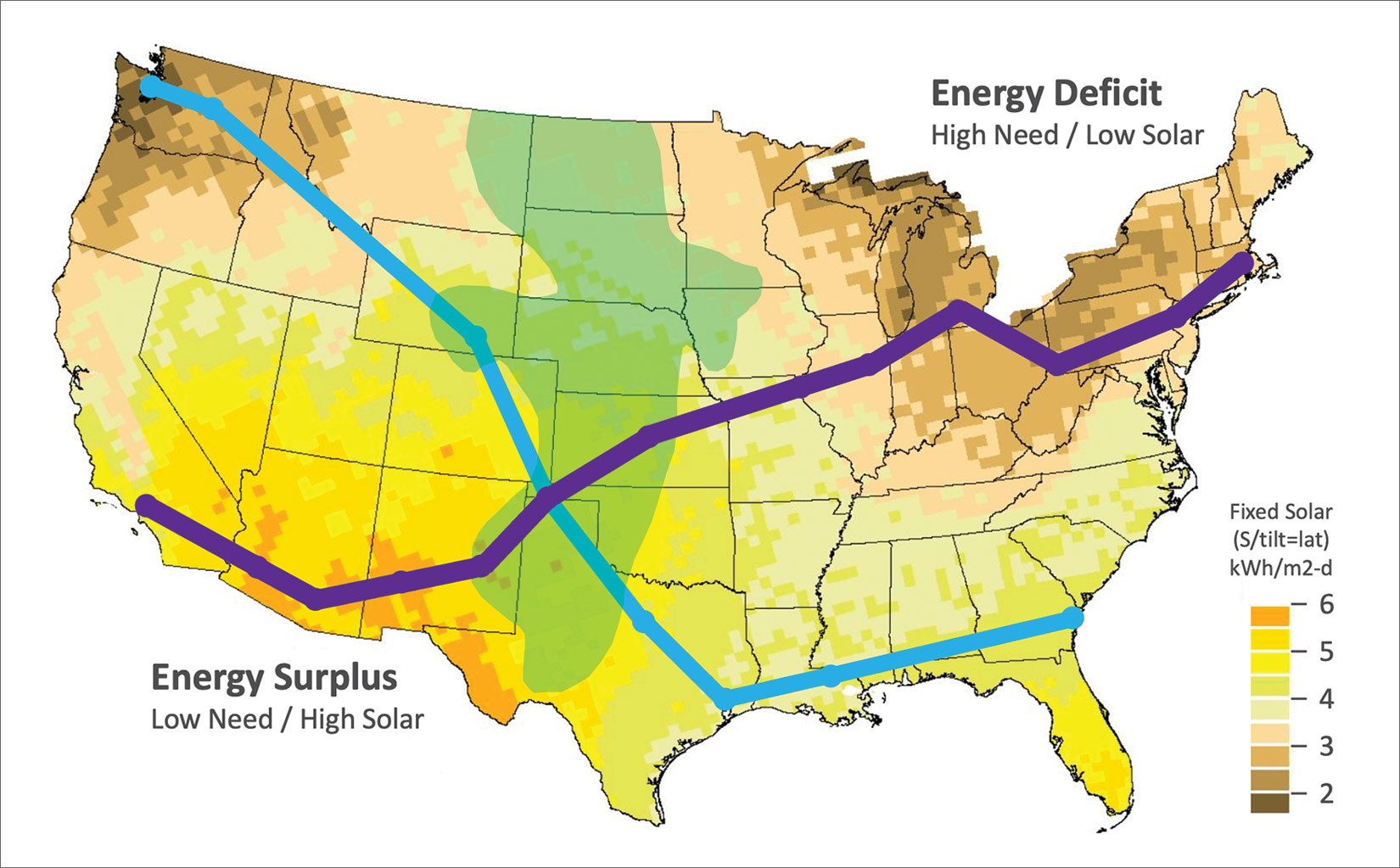

Specifically, this scenario envisions transcontinental Generation-Storage-Load-Export pathways connecting the largest cities and industrial centers with the best wind, solar and water resources and the largest near-urban energy storage sites, creating core federal trunklines into which regional infrastructure can connect. This is illustrated in Fig. 10 as a pair of crossing routes that terminate at major export seaports and link robustly with offshore resources such as wind power and hydrogen production:

- LA-Chicago-NYC corridor for electricity, hydrogen, data and water routed through best solar (SW) and wind production (South Plains) and largest gas storage areas serving the North (MI) and Northeast (upper Appalachia).

- Seattle-Houston-Savannah corridor to access energy storage opportunities, major industrial zones and export facilities.

Aviation and shipping are very difficult to electrify. Federal action to jumpstart production of carbon-neutral fuels to run jets and ships (such as through DOE’s Hydrogen Hub selection) could include areas with access to low-cost wind and sun that connect with major airports and seaports nationwide via dedicated new pipelines in the transcontinental infrastructure corridors. Fuels that power jets and ships can also run stationary electric generation as a primary or emergency fuel.

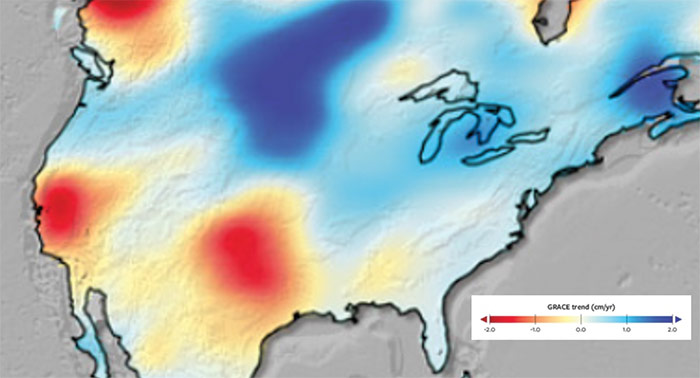

21st century life also depends on water. Regions cold and cloudy tend to have abundant water; whereas in extremely sunny regions water is scarce (Fig. 11). Moving water across the continent is enormously energy intensive, which may finally be a good thing. Highly versatile two-way water pumps could consume surplus wind and solar or be reversed to generate when power is needed. A transcontinental pipeline system linked to existing and new water storage across the country could become the crown jewel of national resilience in times of emergency, power outage and drought.

Fig. 10: 21st Century Transcontinental Infrastructure Corridors. The base map represents typical solar resource in January and the mid-continent green zone indicates good wind power areas. The seasonal challenge of heating the Great Lakes/Northeast is met by tapping desert southwest solar plus adding takeaway pipelines coupled with storage for carbon-neutral heating. The illustrative routes above envision integration with ESIG’s “macrogrid” concept shown in Fig. 8. © Synergetic using NREL and ESIG maps

Closing Thoughts

Energy systems and regulations of today are a product of the past, not the future. Our layered nest of energy regulations still favor the same model Westinghouse used in 1896, a one-way street from large producer to customer, stifling potential innovations of the digital age. While a strong case can be made for fundamental overhaul, near-term progress is also essential for successful decarbonization.

Hydrocarbons have tremendous legacy advantages over renewables that include permanent tax incentives (intangible drilling costs, master limited partnerships), ease of building pipelines (eminent domain), federal investment in strategic reserves (SPR) and a preference in obtaining new power lines as new users of electricity relative to clean energy generators (obligation to serve load). This reality is at the core of why Texas has record and growing oil production while west Texas’ wind and solar are heavily curtailed and new projects canceled, despite being far cheaper and cleaner energy sources. At a minimum, green hydrogen if not all renewables should have access to the same advantages that exist for hydrocarbons.

Fig. 11: Future Rainfall. Under climate change models, northern states are expected to get wetter while the Southwest gets drier. © Pew Trust

Planning in many regions has been historically focused on meeting summer peak, particularly on sunny afternoons. With abundant solar, batteries and demand response, multi-day winter storm events (like Uri) and emergencies where weather-dependent generation underperforms for extended periods will be far greater risks than summer peak.

The infrastructure required to decarbonize is enormous, but needed lines are not getting built. At the heart of the problem is how electric transmission lines are paid for, both on the front end (securing the right-of-way) and the long-term investment. Creative new approaches are urgently needed. The following ideas are suggested in conjunction

with 21st Century Transcontinental Infrastructure Corridors.

Under current electric industry infrastructure cost allocation methods, sophisticated customers tend to benefit whereas unsophisticated customers tend to pay. New mechanisms are needed, including bringing in entirely new sets of payers. An area ripe to explore is financial support for new clean energy electric lines linked to charging of electric vehicles.

Right-of-ways are valuable. Those who benefitted from eminent domain actions of the 19th and 20th centuries and now control railroads and oil and gas pipelines are commonly billionaires, while those who live where the infrastructure passes typically are not. Federal government should retain perpetual ownership of these new corridors and partner with private industry to develop infrastructure. Payments collected by the federal government for use of the transcontinental routes could be shared in some equitable formula, such as royalties split between the previous landowners, impacted local communities, and disadvantaged communities through the Justice4026 initiative.

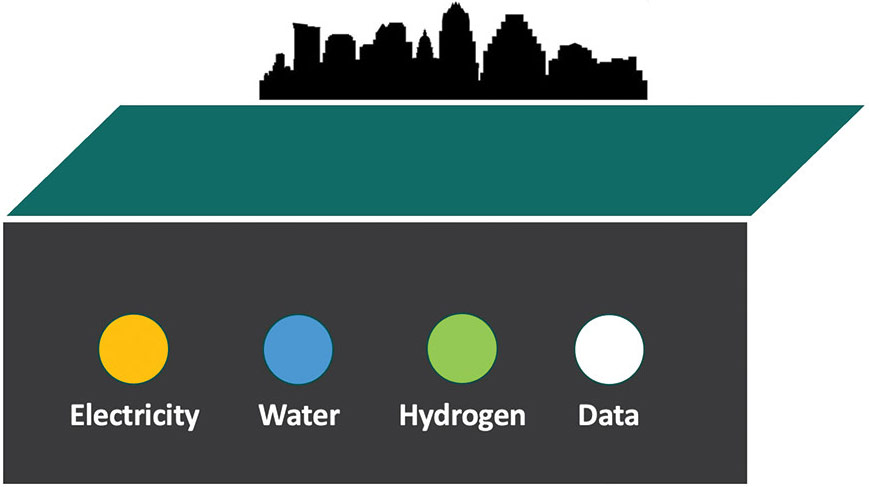

Fig. 12: What if electrolyzers help fuel the digital age? Synergy between electricity, water, hydrogen and data motivates the need for interdependent infrastructure and the practicality of common corridors. © Synergetic

It is anticipated that many landowners will be more receptive to the prospect of ongoing payments based on future corridor value rather than a traditional upfront single payment based on current land value. After holding an “open season” to identify corridor anchor points and users (such as generation, storage and load zones or companies), it may expedite routing to hold an “open season” for interest in providing right-of-way in exchange for ongoing royalty payments among landowners and supportive communities. This approach could be structured to reward early action instead of paying more to holdouts by adopting a sliding scale offering the highest royalty level to early adopters and dropping to zero if condemnation is required.

President Biden’s clean energy goals represent a massive undertaking in new infrastructure and technology development – it is imperative that progress come quickly. The Administration’s whole-of-government action to date declares they intend

to do just that.

About the Author

Mike Sloan is CEO of Synergetic, developer of bundled green hydrogen and electricity infrastructure. He previously spent 33 years specializing in wind, solar, and bioenergy development and “energy policy” as President of consultancy Virtus Energy and as chief executive for The Wind Coalition trade association. Mike co-led framework development for the first successful Renewable Portfolio Standard in the U.S. and was the initial architect and relentless promoter of the widely regarded Texas CREZ policy. mike@synergetic.partners