By Michael Parr April 3, 2023

A floating solar power station is located in Anhui province, China. (Credit: zhongguo)

The Inflation Reduction Act is a sweeping piece of legislation that invests broadly in renewable energy technology and manufacturing and supports healthcare while significantly lowering the federal deficit.

The energy provisions represent a historical shift in the United States’ renewable energy policy from a focus purely on R&D and deployment. Beyond R&D, there is now a more comprehensive framework with significant incentives for domestic manufacturing of PV technologies across the supply chain and PV deployment.

Also, for the first time, the IRA establishes a secure, long-term policy horizon of 10 years, which is critical to supporting large-scale manufacturing investments. It is notably an “all-carrots” approach, using incentives rather than requirements to achieve its goals and the significant employment they will bring. One analysis estimates the IRA could spur 9 million climatetech jobs by 2032.1 The provisions of the IRA are already resulting in significant expansion in U.S. solar-manufacturing capacity across the supply chain.

Let’s start with a little background. In 1839, Edmund Becquerel discovered the photovoltaic effect.

The first solid state photovoltaic cell with an efficiency around 1% was created more than 40 years later in 1883. Photovoltaic cells with meaningful efficiency (approximately 6%) were developed in 1954 at Bell Laboratories.

By 1956, the U.S. Signal Corps Laboratories were developing photovoltaic cells for Earth-orbiting satellites. A solar array of silicon cells with an efficiency of 10% was used to power the radio on a satellite for the first time in 1958 with the Vanguard 1 mission. PV would become the primary energy source for space vehicles.2

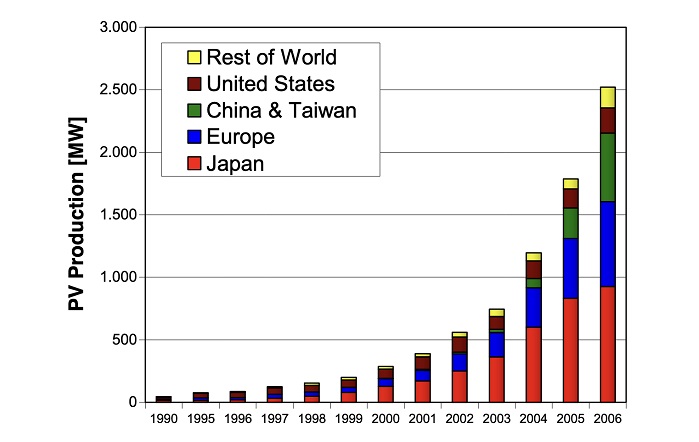

The Japanese company Sharp began commercial deployment of PV technologies in 1963. Ongoing technology development led to significant reductions in the cost to produce a watt of power with solar cells by the 1970s, when commercial applications in remote locations began where grid connection was impractical. By the late 1990s, Japan had commercialized rooftop solar and became the world’s largest producer of solar cells.3 By the year 2000, commercialization had reached a point where the largest producer of PV modules had a capacity of 100 MW of modules per year.4

At the dawn of the 21st Century came a turning point when policy makers began to provide significant incentives for PV deployment. Germany had been using feed-in tariffs (payments for solar power delivered to the grid) to incentivize renewable energy generation since 1991, but in 2003 and 2004 it significantly expanded them.5 In 2004, California Governor Arnold Schwarzenegger proposed a scheme for 1 million solar roofs.6

Chinese companies saw the opportunity to serve this demand for solar goods. In 2002, the first commercial solar-cell-production line was established in China. By 2004, China was exporting solar cells to Germany and other European nations. The 2008 financial crisis badly damaged China’s export-dependent PV-manufacturing industry. The government stepped in with cheap credit to prop the industry up.

As economies began to recover, the demand for solar products rebounded, with Spain and Germany seeing significant growth in PV deployment. The Chinese central government saw the opportunity and made the development of a large-scale export-oriented PV industry a priority.

Access to low-cost capital and other supportive policies led to a profound scale-up in manufacturing across the entire solar supply chain in China, from metallurgical-grade silicon, refined polysilicon and silicon wafers through solar cells and finished modules.

China’s low manufacturing costs, combined with subsidized energy and capital, made the country a particularly attractive place to make PV products. Chinese solar manufacturing quickly reached a massive scale, with individual plants being built at gigawatt scale, more than 10 times larger than the biggest plants just a decade earlier. This allowed China to produce PV products at prices far below the rest of the PV-manufacturing industry, and as a result, PV manufacturing declined sharply elsewhere in the world and expanded in China.7

The last decade has seen virtually all PV-manufacturing growth occur in China. Over the period of 2010 to 2020, global PV-manufacturing capacity exploded from about 25 GW to around 400 GW. To give a sense of the scale of this increase, in the same period that global solar-manufacturing capacity grew by almost 17X, global gross domestic product grew by only about 1/3.

Almost all of that manufacturing growth occurred in China (or was developed by Chinese producers shifting manufacturing to Southeast Asia in response to U.S. tariffs). Chinese producers now represent between 70% and 99% of the total global manufacturing capacity in each of the major components of the PV supply chain (solar-grade polysilicon, silicon wafers and cells, and finished PV modules).8

This dramatic expansion in PV manufacturing scale, the resulting economies of scale, and technology improvements have brought both significant benefits and significant downsides. The main benefit is that the cost of PV modules declined by around 70-80% over the last decade (though other PV system costs and project “soft costs” have not seen similar declines).9 At the same time, many preexisting manufacturing investments outside of China were rendered uneconomic and PV manufacturing declined in the United States and the EU.10

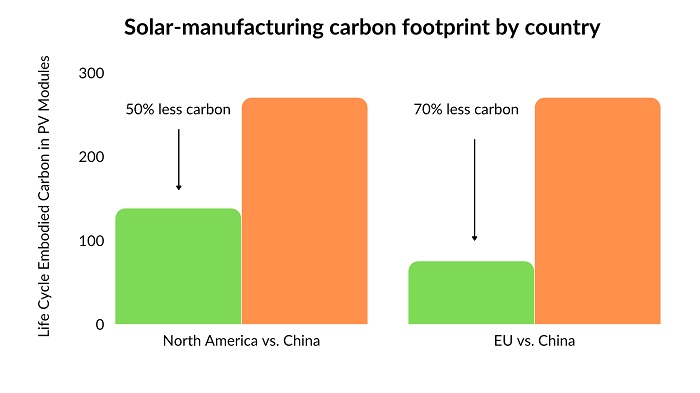

However, because the Chinese electrical grid, despite the decarbonization efforts, remains significantly more carbon-intensive than the United States and EU grids, PV-manufacturing growth in China has resulted in significantly higher carbon emissions than would have occurred had that growth happened in lower-carbon economies.11 Making a PV module in the Chinese solar supply chain results in roughly double the carbon emissions as making a module in a United States and EU solar supply chain.12

The Renewable Energy Buyers Institute estimated that if the growth in solar manufacturing needed to meet PV demand over the next 20 years occurs primarily in China, it would result in an additional 20 billion tons of carbon emissions.13

Further, there is extensive evidence that solar manufacturing, like many industries in the Xinjiang Uyghur Autonomous Region of China, is tainted with the use of forced labor.14

This highly concentrated and unsustainable Chinese solar supply chain has also become increasingly fragile. Energy, labor and shipping disruptions associated with the pandemic as well as policy responses to the forced labor concerns have resulted in an increasingly unreliable supply of Chinese modules to Western markets.

Solar buyers and the U.S. government have grown increasingly concerned about these risks inherent in the current solar supply chain. Buyers have begun to sign long-term supply agreements for U.S.-produced PV modules to both secure module supply and encourage expanded U.S. PV manufacturing.

Private- and public-sector buyers also sought sustainably manufactured PV products with lower levels of embodied manufacturing carbon emissions. For example, the U.S. government specified EPEAT-certified modules as the sustainable-acquisition standard for federal agencies.15 EPEAT is a third-party-verified sustainability standard/ecolabel for electronics to which the parent organization, the Global Electronics Council, has recently added detailed embodied carbon criteria.16

Recognizing the pressing need for a more resilient, sustainable solar supply chain, the U.S. Congress made incentives for domestic solar manufacturing a significant component of the IRA. It also encouraged the use of domestically produced materials in the IRA’s significant incentives for solar-deployment growth.17

The IRA aims to reverse the trend of offshoring solar manufacturing and drive expansion in polysilicon, silicon wafers, solar cells and module production in the United States, along with production of ancillary materials and equipment used in solar projects.

The effects of these incentives are already being seen in rapid expansion in domestic solar-manufacturing capacity. Gigawatt-scale expansions are announced or underway in the production of polysilicon, silicon wafers, solar cells and PV modules.18, 19

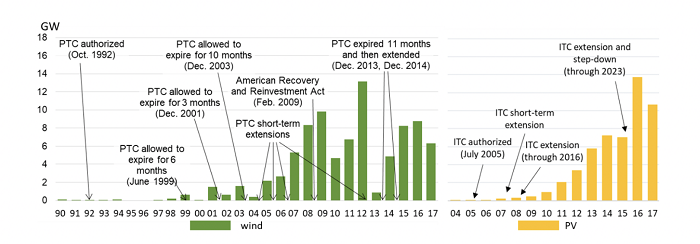

The IRA differs from past United States federal solar policies in important ways. In the past, incentives went only toward solar deployment. Policies like tax credits for installed solar projects were silent on the source of the PV products used. Those credits tended to be technology-specific and vary for solar and other forms of renewable energy, were approved for relatively short time periods, and required occasional Congressional action to be extended. They occasionally lapsed altogether before being reimposed. When they were approved for longer time periods, the credit values were often “stepped down” quickly.20

As the graphic below shows, the lack of stability in these shorter, often unpredictable extensions of the tax credits created rather “lumpy” investment cycles in both wind and solar capacity in the United States.

The IRA has modified this approach substantially. Credits for renewable energy deployment have been put in place for a secure 10-year period and do not require intervening Congressional action. They remain at consistent credit levels for eight years before declining rapidly. After a brief transition period, the credits become technology-neutral, with the same credit structure for solar and wind. For the first time, there are tax credits for deploying energy storage technologies as well. There are Production Tax Credits for manufacturing a variety of other clean energy and storage technologies.

These credits include additional “sweeteners” that increase their value if certain levels of domestic content, wage rates and apprentice labor are met in the relevant projects. These provide additional incentives both for more domestic manufacturing and for solar workforce development.

And unlike the Renewable Portfolio Standards that have been popular in states and past efforts to pass a federal Clean Energy Standard Act, the IRA’s provisions are purely incentives, with no requirements; it is all carrots.

And while the American Recovery and Reinvestment Act of 2009 provided significant levels of funding for clean energy technologies in the form of grants, loan guarantees and tax credits, it was a relatively short-term infusion of financing. The IRA provides manufacturing incentives with the same secure 10-year runway as the deployment incentives.

Importantly, the ability to monetize the credits, such as selling them to third parties, has been made much more flexible for both the manufacturing and deployment, enabling a greater range of financing opportunities.21

The IRA’s solar incentives are not dissimilar to India’s Production Linked Incentive program, which aims to build a 40-60-GW integrated solar supply chain in India by subsidizing PV manufacturing.22 In the EU, similar efforts are underway to rapidly scale up a 30-GW solar supply chain under the European Solar PV Industry Alliance.23 And the European Commission also recently announced its intent to develop a Net-Zero Industry Act to incentivize clean energy manufacturing in the EU.24

Combined with the cost-competitiveness of renewables driving increased deployment, these programs are beginning to transform the energy landscape. Solar deployment is growing at 8-12% compound annual growth and is the fastest-growing form of energy in many parts of the world.22 To keep up with that demand, and to create the more resilient, diverse and sustainable solar supply chain the International Energy Agency and others support, significantly expanding the scale of solar manufacturing across the globe needs to occur. The IRA is a critical element of that.

In its 2022 Renewables Outlook, the IEA said, “PV-manufacturing investment in India and the United States is expected to reach almost $25 billion USD over 2022-2027, a sevenfold increase compared with the last five years. India’s Production Linked Incentive initiative closes nearly 80% of Indian manufacturers’ investment cost gap with the lowest-cost manufacturers in China. Meanwhile, fully monetizing manufacturing tax credits in the United States could bring all segments of PV manufacturing to cost parity with the lowest-cost manufacturers.”25

Growing demand for clean energy combined with sustainability and supply challenges in the current solar supply chain have resulted in widespread demand for a more sustainable and resilient solar supply chain with a lower carbon footprint. The IRA and policy counterparts elsewhere in the world respond to this demand and portend a bright future for low-carbon solar energy.

Sources

- https://tinyurl.com/3me2s6xu

- https://tinyurl.com/2z6f28hd

- https://tinyurl.com/mptjrycr

- https://tinyurl.com/5n6f5mxj

- https://tinyurl.com/2pza79fw

- https://tinyurl.com/2zv3cme9

- https://tinyurl.com/yu3aw5st

- https://tinyurl.com/53597nm9

- https://tinyurl.com/2nrr2755

- https://tinyurl.com/dx6vvpmf

- https://tinyurl.com/2nxhppbt

- https://tinyurl.com/mtz2wyh4

- https://tinyurl.com/hh47nh3v

- https://tinyurl.com/ymkjejwm

- https://tinyurl.com/599yt5hu

- https://tinyurl.com/3dr6ktbh

- https://tinyurl.com/3e339de4

- https://tinyurl.com/2m695d9h

- https://tinyurl.com/4jrvmzwr

- https://tinyurl.com/3tfkzj56

- https://tinyurl.com/5awr7kxc

- https://tinyurl.com/nyxw7t4u

- https://tinyurl.com/4usn22n4

- https://tinyurl.com/ypjwfks9

- https://tinyurl.com/2wnhe9uz

About the Author

Michael Parr is the executive director of the Ultra Low-Carbon Solar Alliance, a coalition of solar-manufacturing companies using market forces to decarbonize the solar supply chain, making clean energy even cleaner. Michael brings 40 years of experience in manufacturing, energy and sustainability, along with carbon mitigation, to this role.